Did Tariff Man or Yield Curve Tank Stocks?

It was an exhausting week for investors, even though there were only four trading sessions. Monday’s U.S.-China 90-day trade “time out” stock bounce was dwarfed by big sell-offs throughout the rest of the week. The drubbing began after the President’s tweet that he is a “tariff man,” shortly followed by another, which questioned whether a “real deal” with Beijing is actually possible.

The uncertainty around trade continued to spook investors a day after the national day of mourning had shuttered markets. On Thursday, the government announced the trade deficit widened to its highest level in 10 years in October and adjusting for prices, both exports and imports were down. Additionally, the arrest of Huawei Technologies’ chief financial Meng Wanzhou in Canada on claims that she and the company violated U.S. sanctions against Iran, only escalated tensions between the world’s two largest economies.

Trade concerns alone may not have tanked stock markets 4 to 5 percent over the week, but on top of the nagging anxiety about a global growth slowdown, the sellers were out in force. One sign of tension was seen in the bond market, where the difference between short-term and long-term government bond interest rates narrowed.

WARNING: HERE COMES A DISCUSSION OF AN INVERTED YIELD CURVE!!!

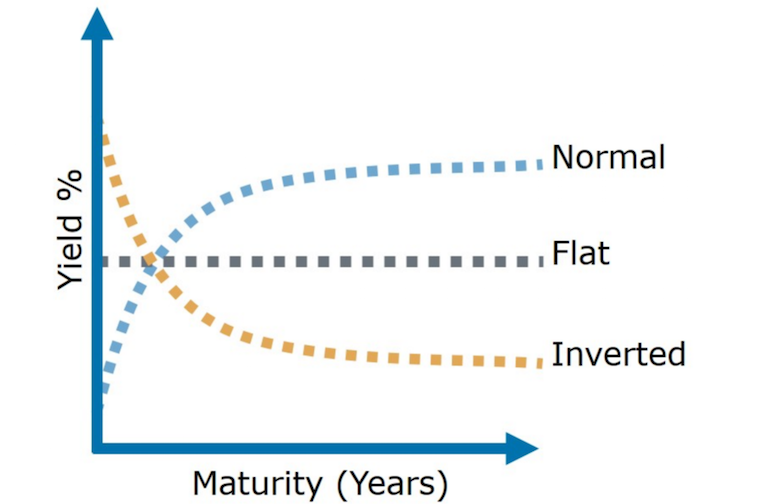

Let’s start with some bond market basics. Typically, it should cost less to borrow for shorter periods of time than longer ones. In the case of government bonds, when you buy a ten-year bond, the interest rate is normally higher than when you buy a two-year (the difference between those two interest rates is known as the “spread”). The reason is that lots of things can happen in the future, most notably, inflation can eat away at your fixed bond payments. Bond buyers usually demand higher interest rates to compensate them for the additional risk of the longer time period.

When you plot interest rates on a graph, a normal yield curve will slope upwards. The steeper the slope, the more that investors think that inflation and interest rates will rise in the future. When investors believe that growth is slowing and that the rate of inflation will be tepid in the future, then the yield curve flattens out. That’s kind of where we are right now.

BUT, when short-term interest rates are higher than long term rates, that is called an inverted yield curve – meaning that it slopes downward. And here’s the hair on fire part: every U.S. recession for the past 60 years followed an inverted yield curve, though sometimes not until months or even years later. Last week, the gap between three and five-year government bond yields dropped below zero for the first time since 2007 and the spread between two and ten year bonds, the most important relationship, narrowed to 0.11 percent, the narrowest since 2007. That’s not technically inverted, but it got already freaked out investors even more freaked out.

As noted in previous posts (here, here and here), growth peaked in the second quarter and is now downshifting. If you believe (as I do) that investors drove up stocks on the notion of a more lasting growth boost from tax cuts and government spending, then the recent selling makes perfect sense. The question now is really about whether current valuations are still too high, relative to the ability of companies to make money in a slower growth environment.

Three Important December Dates

With the monthly jobs report behind us (the Labor Department reported that the economy added 155,000 jobs in November, slightly below estimates. The unemployment rate remained at 3.7 percent, which was the lowest level since 1969; and wages were up 3.1 percent from a year ago, the best year over year growth since April 2009), there are now just three important dates to circle on your economic calendar:

December 11: The British House of Commons will deliver its verdict on Brexit

December 19: The Fed is expected to announce its final rate hike of the year

December 21: Government Funding deadline

All of these events are potentially market moving, so you may need a few extra latkes and a stronger batch of eggnog this December!