Days before the election, various economic reports painted a picture of a solid economy on strong footing, though you would not know that if you saw a recent poll.

Read MoreWhether or not NBER officially makes the recession call, it’s becoming obvious that a slowdown has begun.

Read MoreJust in time for Halloween, two reports spooked economists. Does this mean that the U.S. economy looks like zombies from The Walking Dead?

Read MoreIn March, I wrote about how investors should prepare for inflation and then two months later, I wondered whether high prices would persist. So far, the answer to that question is a resounding, “at least for a while!”

Read MoreMid-year is a perfect time to catch our collective breaths and take stock of where the economy is, and could be heading. Welcome to Intermission 2021!

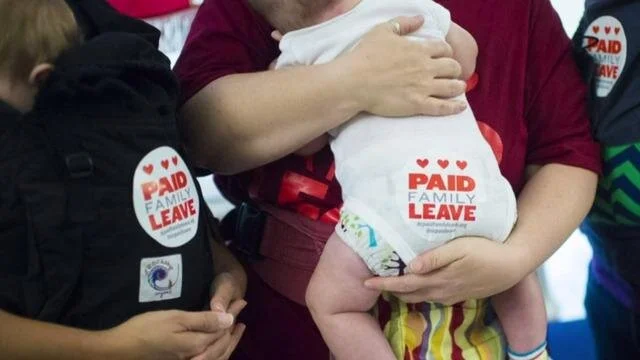

Read MoreThe financial freeze of COVID-19 is thawing. 2020 was the worst year for the U.S. economy in decades, but as vaccinations have ramped up and government stimulus efforts continue, 2021 has started on strong footing.

Read MoreThe combination of accelerated vaccine distribution + trillions of dollars of emergency federal spending + warm weather + pent-up demand + low interest rates = Roaring Twenties for the U.S. economy.

Read MoreThe first week of November will be presented by the letter “V”… V is for VOTE, VIRUS and VOLATILITY, the themes that will dominate financial markets in the days, and potentially weeks, ahead.

Read MoreThis week, the government will release its first estimate of economic growth (GDP) for the third quarter and it’s going to be a welcome relief from the first half of the year.

Read More